Vital Information Services (Pvt) Ltd.

Excellence in Credit Assessment Models Since 1994

Excellence in Credit Assessment Models Since 1994

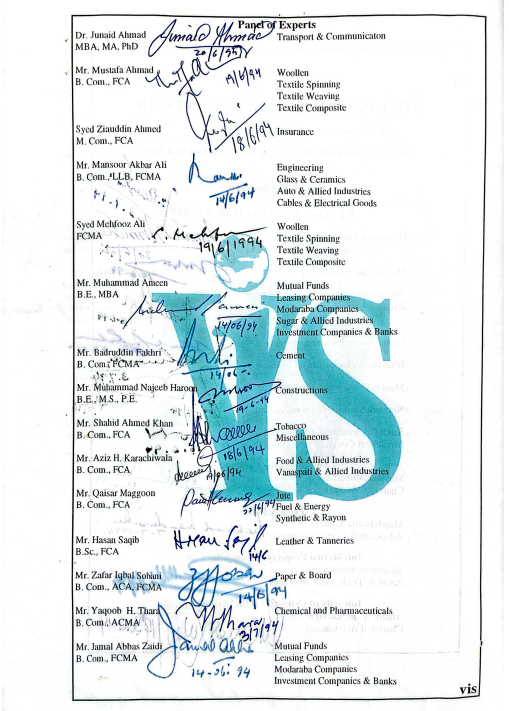

Developing, testing, and validating credit assessment models for over 30 years. Our models determine probability of default for large, medium, and small entities across various industrial sectors.

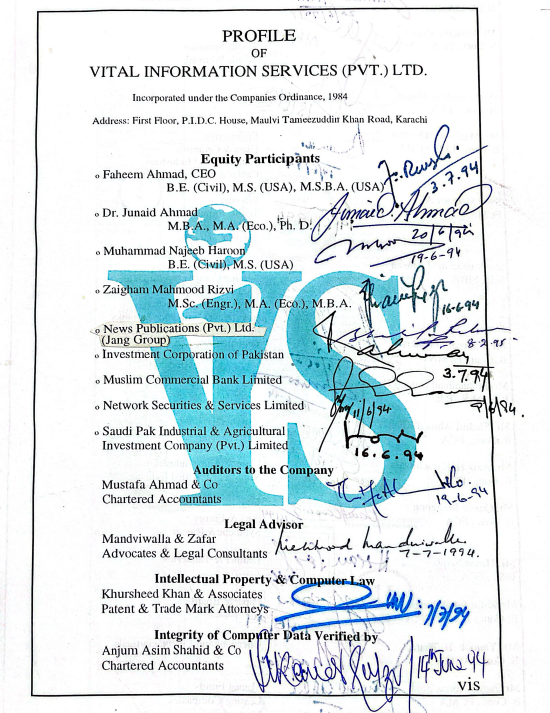

Director & Founder

Director & CEO

Director

Director

Director

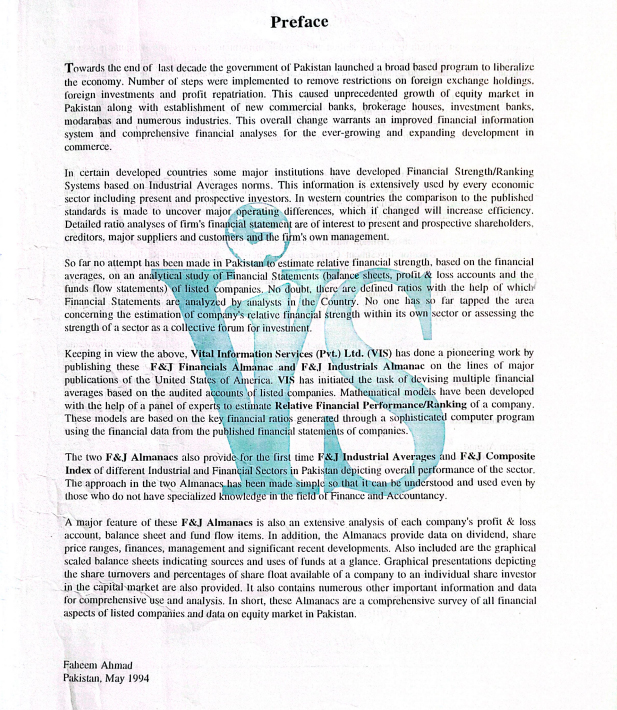

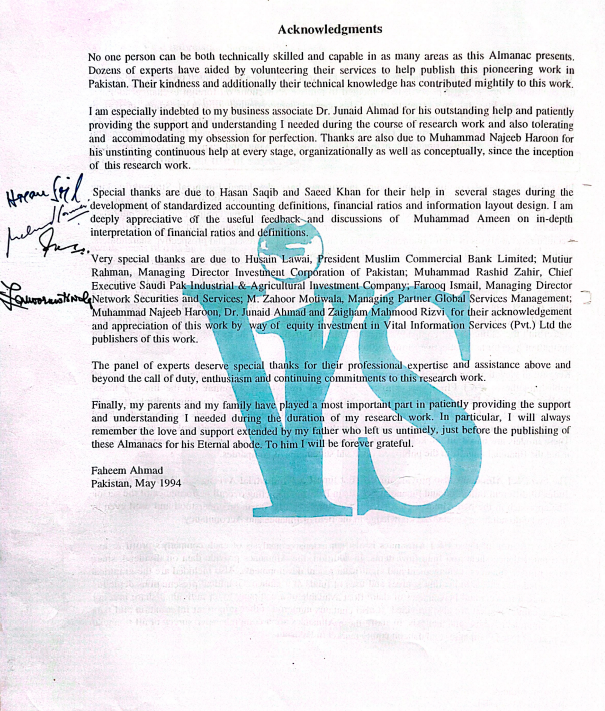

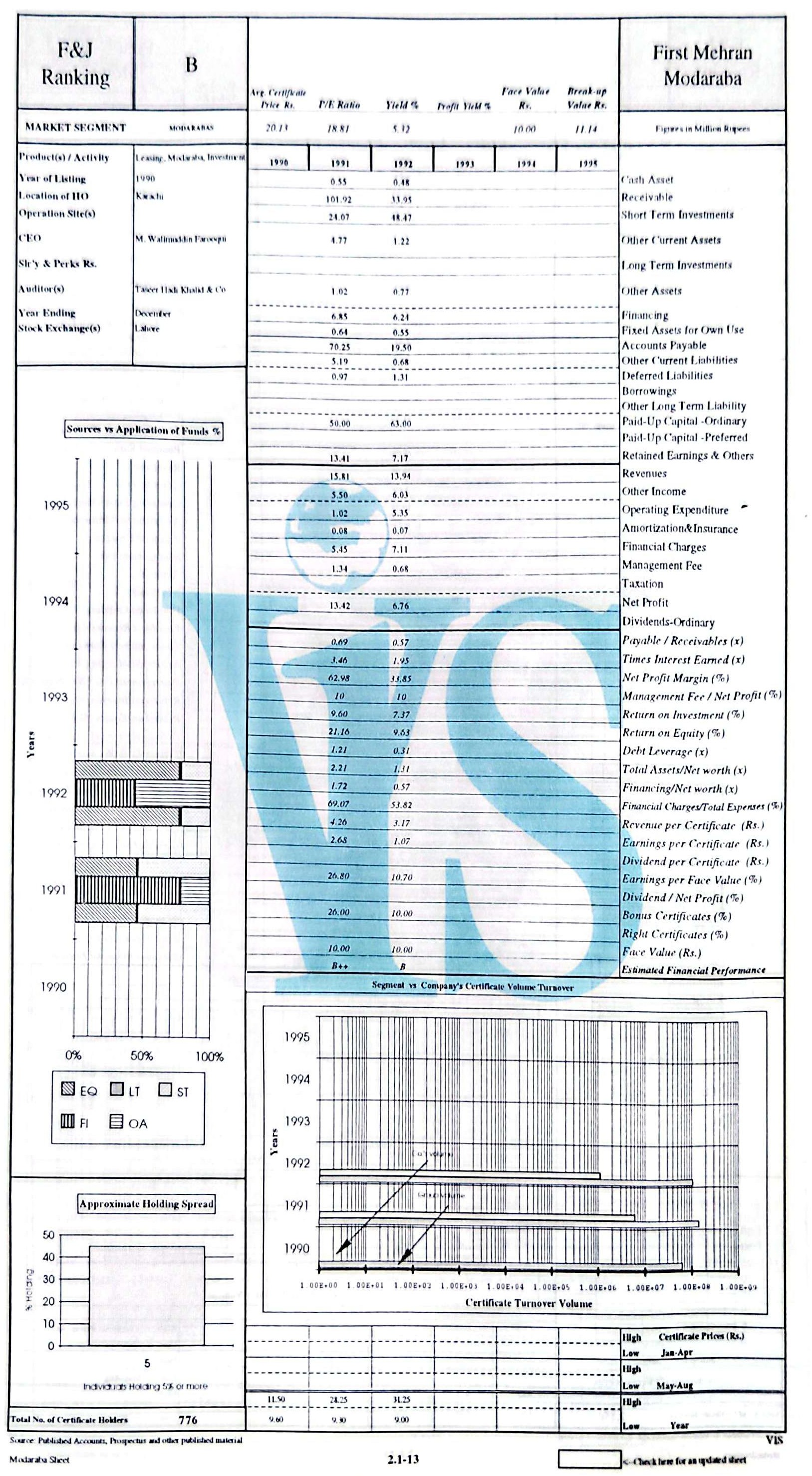

The two volumes of F&J Almanac, i.e., Financials and Industrials, contain historical financial and capital market data of approximately all listed companies on the Karachi Stock Exchange for latest six years. F&J Almanacs provide very comprehensive and accurate financial and trading data needed to make investment decisions.In early 2000's the company released the first digital version of the almanac.

VIS compiles and disseminates useful Stock Exchange data through the monthly tabloid of The News, called INVESTOR'S - A Business & Finance Journal. VIS also contributes company analyses, trading analysis, inflation analysis and articles on various subjects, in this publication, which is distributed free with 'The News'.

To assist credit/financial analysts in financial institutions and stock brokerage houses, VIS has developed a prize winning software, VISTA - VIS Total Analyst. VISTA puts the entire VIS database on corporate Pakistan at the disposal of analysts who can carry out their own analysis, prepare displays and hard-copy reports.

* Awarded First Prize 1998, in Business/Office type of software in Professional Category by Dr. A. Q. Khan Research Laboratories, Government of Pakistan.

VIS has continuously pioneered innovation in financial research and data services. From developing comprehensive financial databases to creating award-winning analytical software, VIS has broken time barriers in delivering critical market intelligence. Our journey includes developing unique products like the Household Inflation Index in collaboration with Applied Economic Research Centre, the Economic Monitor quarterly publication, and the innovative Confidence Barometer that tracks investor sentiment in the stock market.

Beyond Pakistan, VIS expanded internationally through joint ventures, including establishing DCR-VIS Credit Rating Company with Duff & Phelps Credit Rating Co. (USA) and expanding operations to Bangladesh through Credit Rating Information & Services Limited (CRISL). This journey of innovation has positioned VIS as a cornerstone of Pakistan's financial information infrastructure.

KARACHI: A group picture taken during the presentation of VIS Musharaka Investment Model. Sitting from left to right are: Faheem Ahmed, CEO, Vital Information Services, Dr. Abdulsattar Abu Ghuddah, Secretary General, Uni-fied Sharia Board, Financial Sector, Member of Islamic Fiqh Academy, Jeddah, Justice Taqi Usmani, Judge, Shariat Appellate Bench, Supreme Court of Pakistan, Dr. Mohammad Elgari, Director, Centre for Research in Islamic Eco-nomics, King Abdul Aziz University, Jeddah, Javed Mohammad, EVP and Chief Corporate Officer, Prime Commercial Bank. ~ The News photo

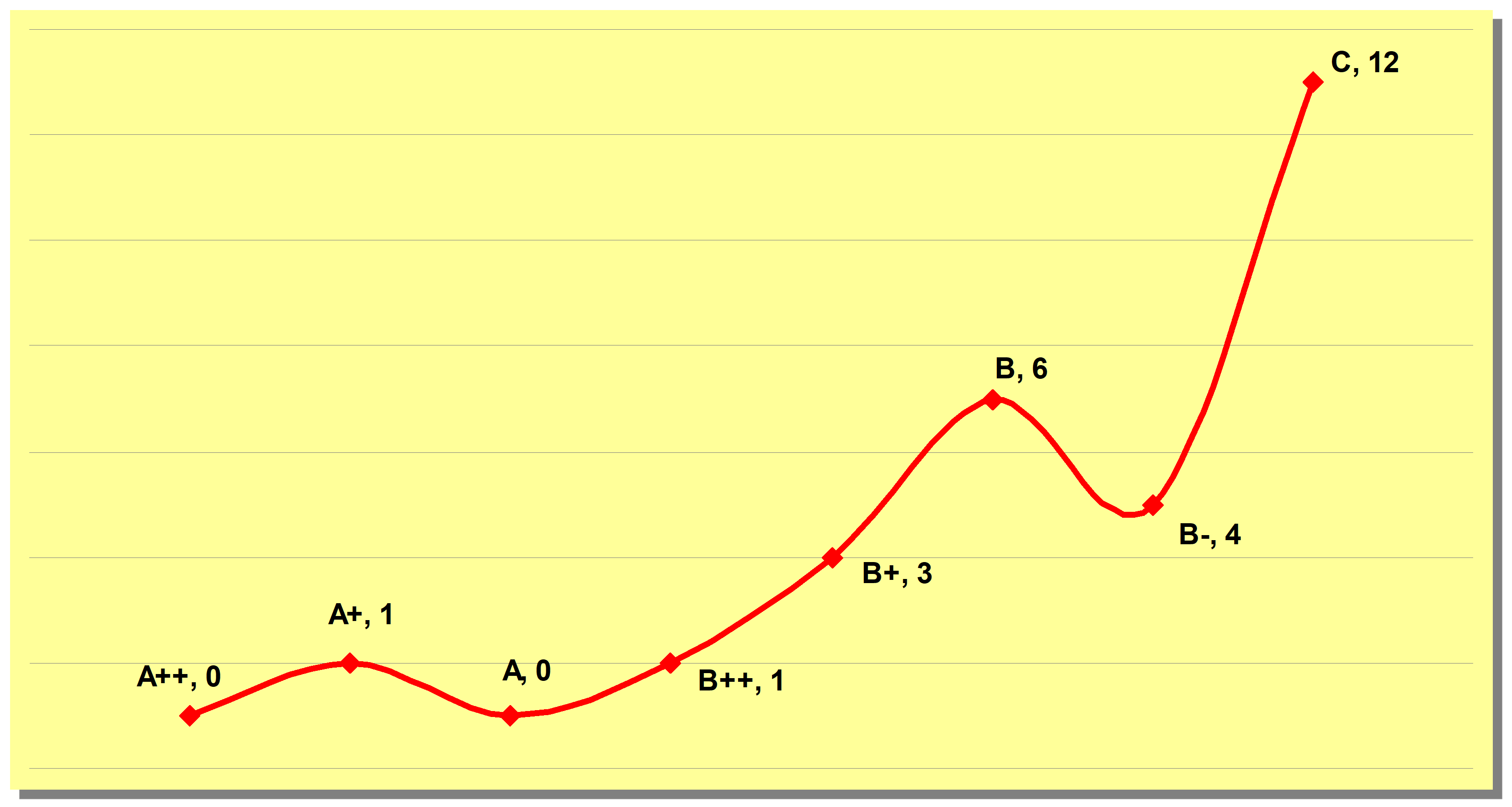

VISPL, the majority shareholder in VIS Credit Rating Company Limited, has developed comprehensive credit assessment models that are:

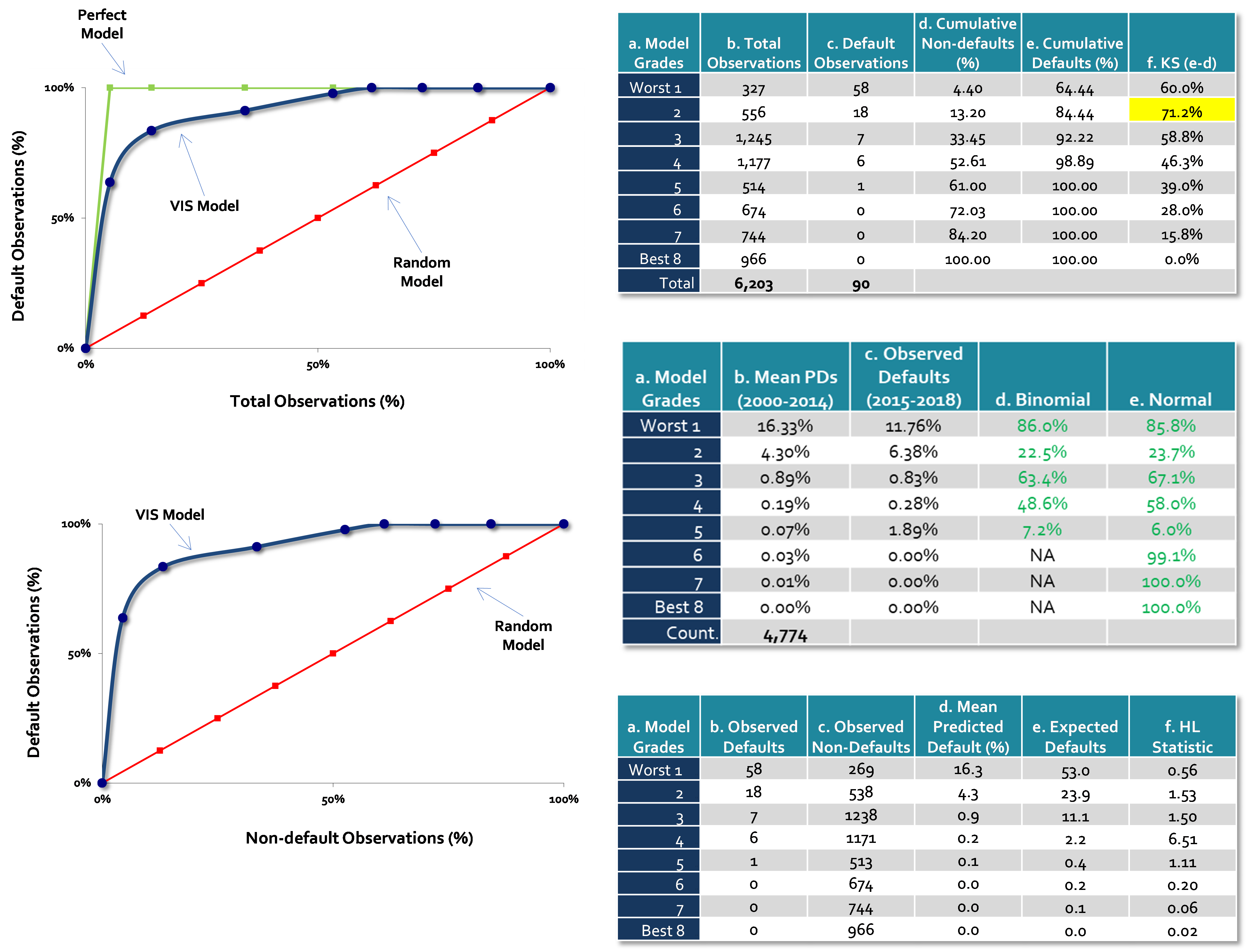

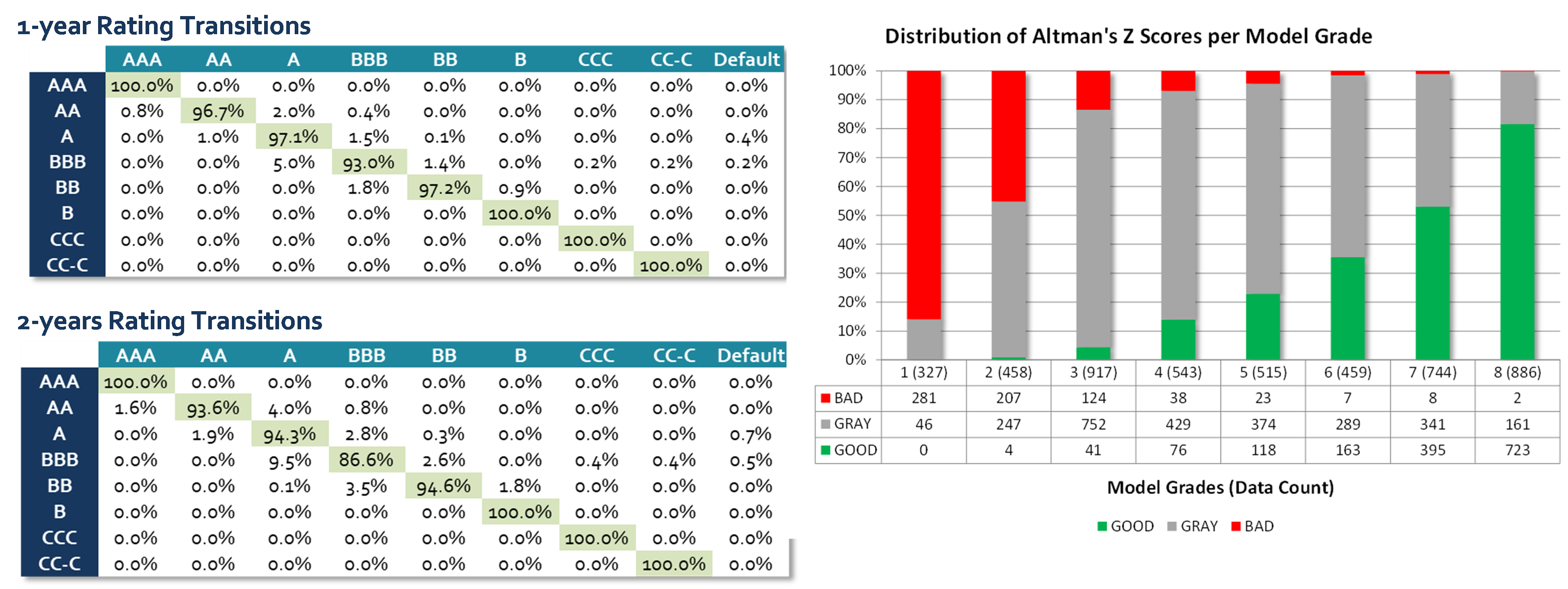

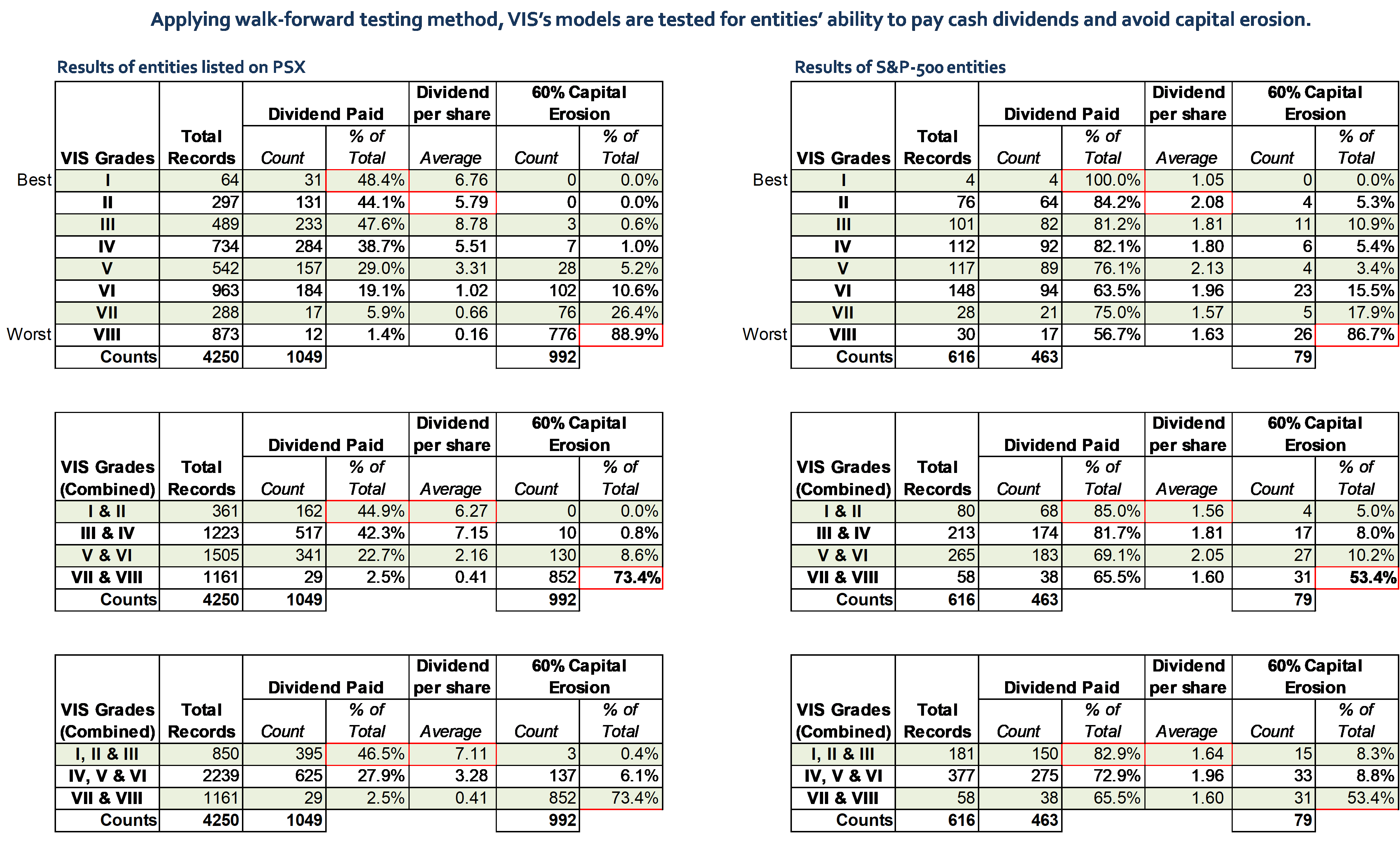

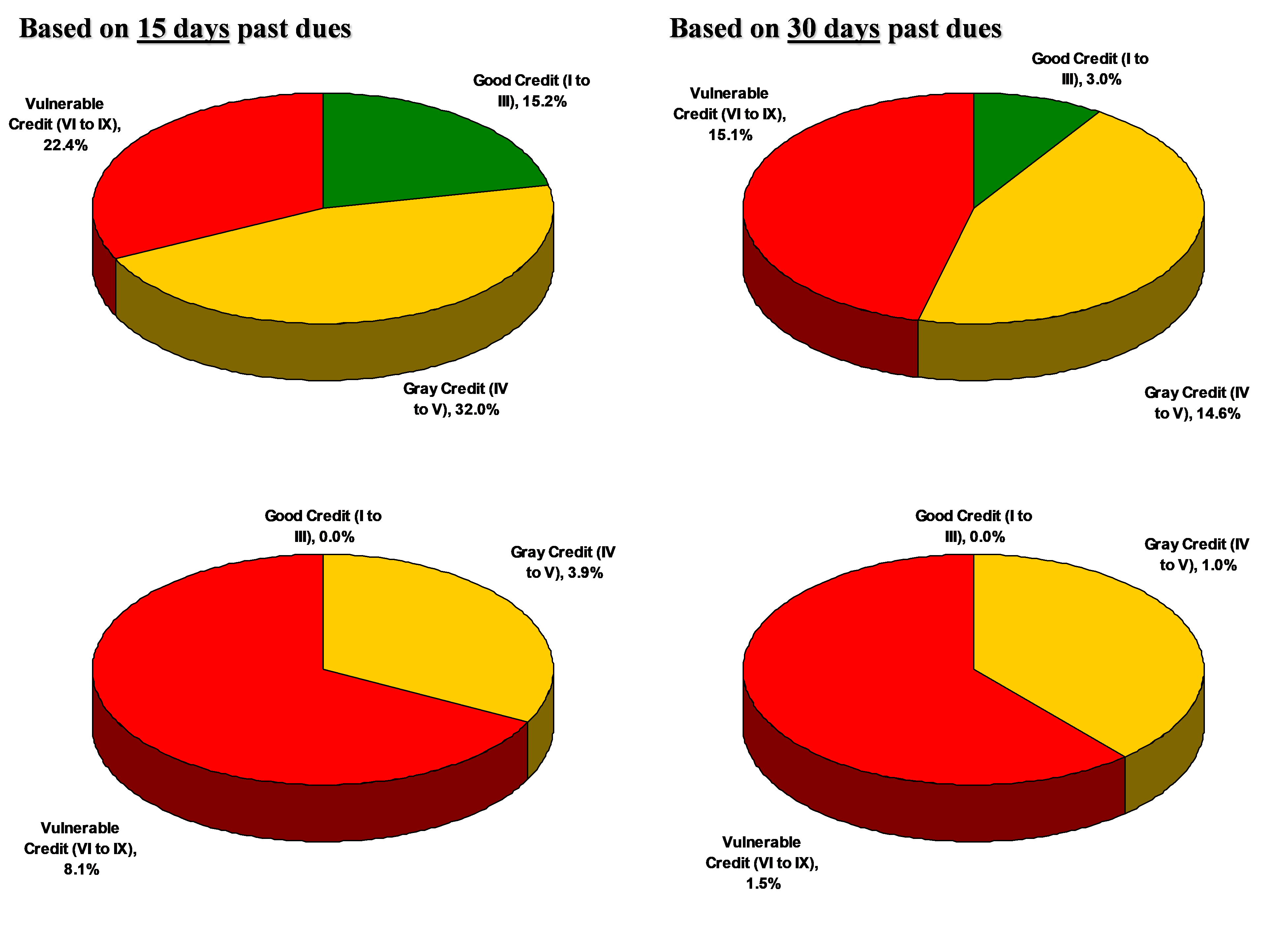

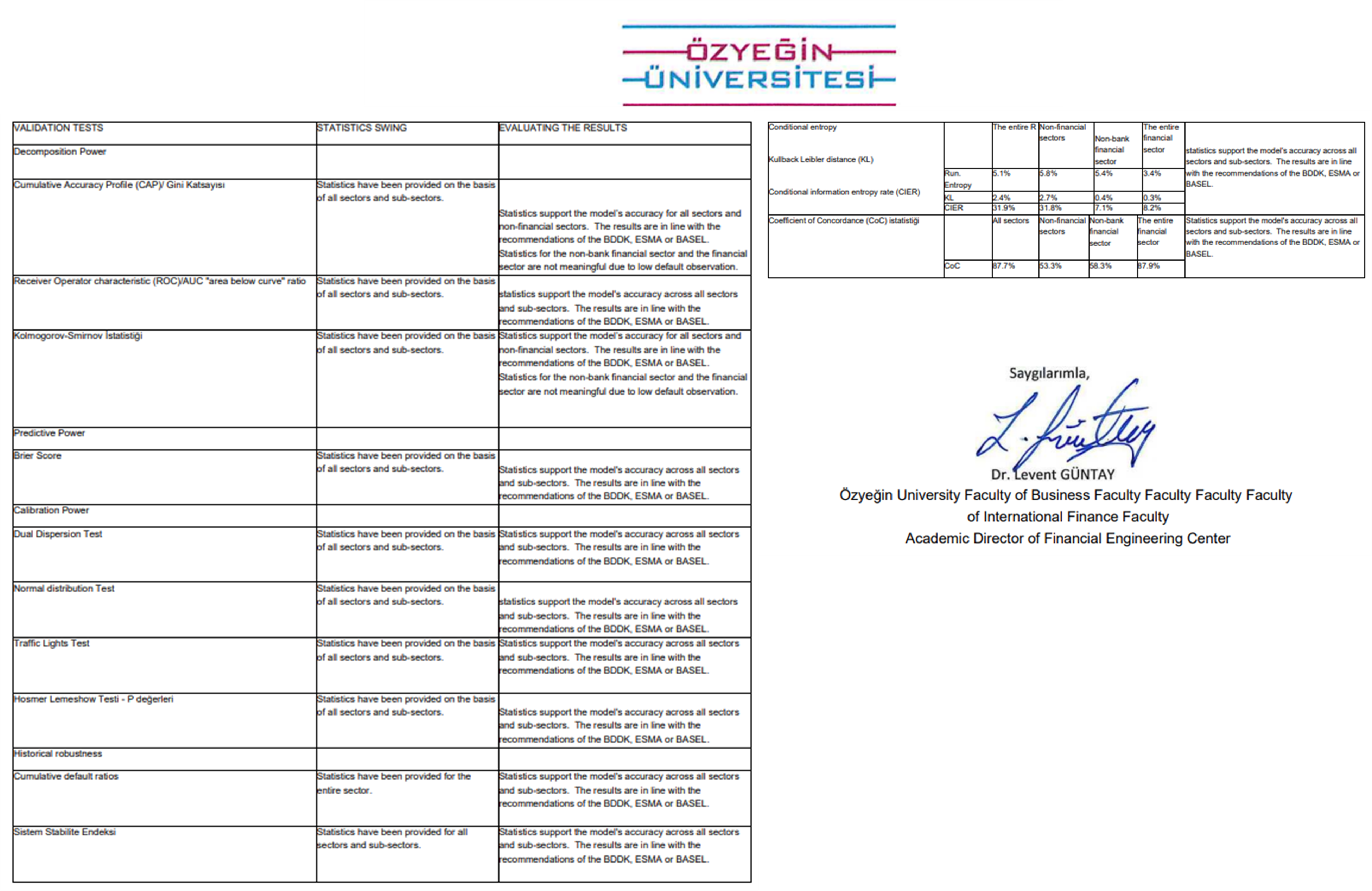

Our models undergo comprehensive validation following international regulatory standards including ESMA Guidelines (2017) and Basel Committee Working Papers.

Validations conducted on extensive datasets spanning over two decades

Models tested across different jurisdictions and licensed rating agencies

Separate treatment for SMEs considering legal and corporate structuring differences

Following European Securities & Market Authority guidelines and Basel requirements

Enhanced dataset using proprietary VISTA Plus database

Results verified by internationally renowned academicians

Our validation process and generated results are verified by internationally renowned academicians, ensuring the highest standards of accuracy and reliability.

📄 Levent Guntay CV (PDF)